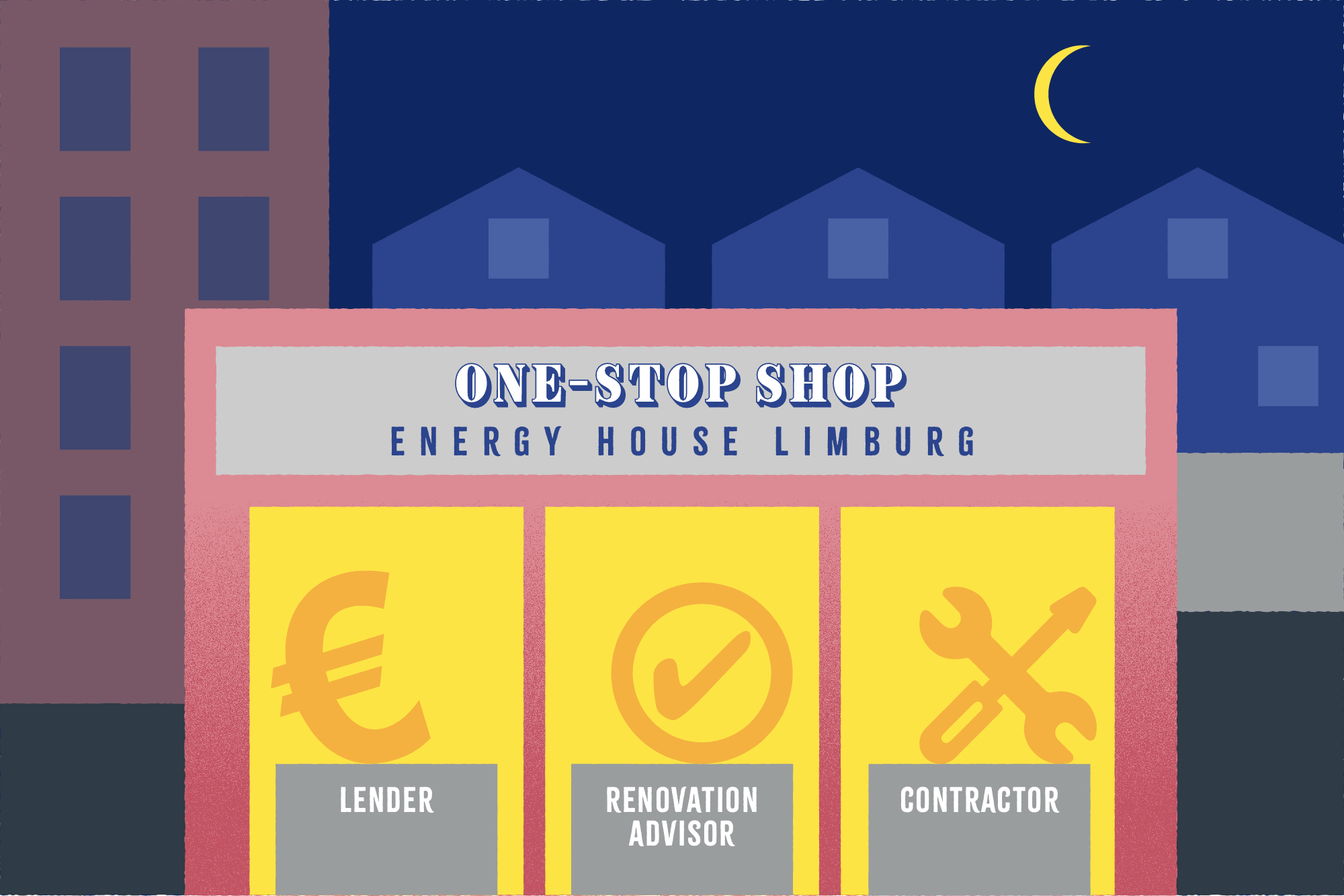

One stop shop structure

The C-R.E.A.L project materialised a structural collaboration between the mortgage lender Onesto and the renovation consultant Dubolimburg in the framework of the one-stop-shop Energy House Limburg Belgium and developed tools for the renovation guidance of houses and apartment buildings.

To achieve an optimal customer experience, structural cooperation with the construction sector was set up under the form of a 'renovation collective' consisting of 50 contractors and 7 architects. The renovation collective refers to a group of contractors and architects who have come together to work closely with renovation consultants, leveraging their expertise to improve their services and foster more efficient and informed interactions with clients. In setting up these structural partnerships and offering integrated home renovation services, the consortium focused on 3 primary target groups that they guided through the entire customer journey: home buyers, owners who already have a current mortgage and co-owners’ associations (ACOs).

C-REAL provided feedback to the Flemish Energy and Climate Agency (VEKA) on fine-tuning the preconditions for the provision of a long-term ACO loan by the Energy House Limburg (e.g. by suggesting the increase of the repayment period from 10 to 25 years following several stakeholder meetings with the Flemish Government). This allows the ACO to borrow cheaply for works on the common parts, increases its financial clout and boosts the renovation rate (financing solution part of the renovation advice).

Developing a funding solution tailored to Associations of Co-Owners (ACO):

The ACO ‘Mijn Verbouw Lening’ loan, is a loan for renovation works with a favourable interest rate (2.7%) and tailored to the needs of the ACO, which was launched by the Flemish government. The ACO loan is up to 60,000 euro per building that can be increased by 25,000 euro per residential unit and has a duration of up to 25 years. Today, the loan is distributed by the Flemish Energy Houses, which are also responsible for credit assessment. To relieve the Energy Houses from the risk, an agreement was also concluded with Atradius, a credit insurer. From now on, any request for a loan for a ACO, whether bank or governmental, must be accompanied by credit insurance via Atradius. Consequently, once Atradius agrees to insure the credit, the Energy Houses are relieved of any risk. Thanks to the integration of the Mijn Verbouw Lening for ACOs, within C-REAL they were able to work out tailor-made financial advice for each ACO:

- Breakdown of renovation into energy works (MVL) and non-energy works (banking circuit);

- Division of financing into MVL and bank loan;

- Guidance on applying for credit insurance;

- Advice for each individual co-owner to see what could be the best financing solution for him/her.

Now, every financing request is tailor-made. There is no one-size-fits-all, each financing proposal should be tailor-made.

Main achievements of C-REAL:

- Home renovation advice to 846 homeowners in 139 singles homes and 707 apartment (20 multifamily buildings)

The average investment is of around 40k euros per dwelling, with average reduction by about 49% in the EPC value. The average investment generated per ACO of the initiated renovations (of 20 old apartment buildings in Limburg, representing 707 units) is 583k euros.

MORE INFORMATION

- Reference

- H2020-EU.3.3. - SOCIETAL CHALLENGES - Secure, clean and efficient energy

- Project duration

- 1 Sep 2020 - 31 Aug 2024

- Project locations

- Belgium

- Overall budget

- €1 514 405

- EU contribution

- €1 514 405100% of the overall budget

Stakeholders

Coordinators

STEUNPUNT DUURZAAM BOUWEN LIMBURG

- Address

- CENTRUM-ZUID 1111, 3530 Houthalen-Helchteren, Belgium

- Website

- https://www.dubolimburg.be/nl